What is your debt to income ratio...why should you care?

Any time you have more income and less debt, you’re in good shape in life. That said, there is an ideal ratio between your debt and income in order to qualify for a good mortgage.

When your debt to income ratio is on the high side, you run the risk of not getting a good loan (or not getting a loan at all) if your income were to take a hit right before or during the loan funding process.

Conversely, having no debt can work against you, too, as your credit score might not be as robust as it needs to be if you have a seasoned credit record showing you accruing some debt and then paying it off.

Here's a closer look at what your debt-to-income ratio is and how it works.

Your Debt-to-Income Ratio Explained

It’s fairly simple. You have income that comes in from your job, investments and other sources from which you get paid. This is the money you use to service the debt.

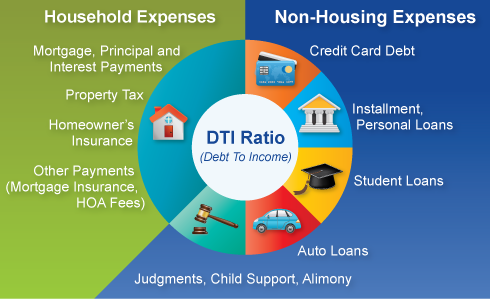

Then, you have your debt: recurring and regular spending. Every month, you have recurring bills like cell phone, car, cable, mortgage, credit cards, etc. After that, there’s regular spending on things like food, gas, clothing, etc.

Now, if more of your income goes to paying your debts instead of being put away for savings, then you might have a high debt-to-income ratio (DTI) scenario. Specifically, the debt-to-income ratio is a number that details the relationship between your total monthly debt and your gross monthly income.

If we were to put it into a formula, it would look like this:

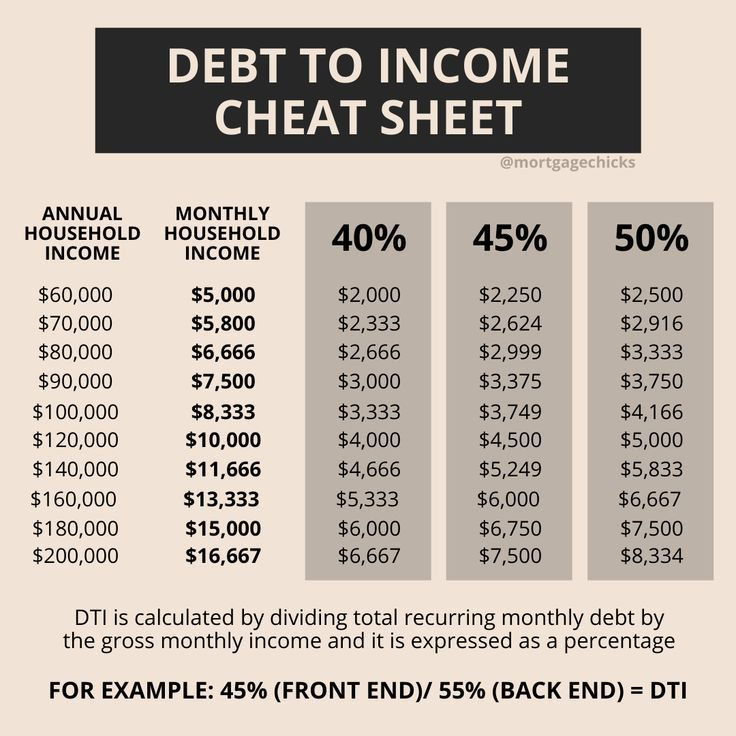

DTI = total monthly debt payments/gross monthly income

Here’s an example: Say you pay $1,500 a month on your mortgage. You pay $500 a month for your automobile loan and other than that, have no other substantive debt. Your total monthly debt payments come to $2,000. At the same time, let’s assume your gross monthly income - the money you earn before taxes and any deductions you take is $6,000.

Total monthly debt payments ($2,000)/Gross monthly income ($6,000) = DTI 33%.

It’s that simple. Now, let’s take a look at why your lender puts so much importance in your DTI.

Why is your DTI so important?

Your DTI tells you a lot about you and how solid - or problematic - your financial situation is.

For instance, if your debt needs to be covered by 60% of your income, any negative change to your income will leave you in a tough spot. Or, if you have to increase your spending for other areas of your life, let’s say doctor’s visits and medical expenses, you could have a rough go of it in keeping up with your debt payments vs. someone who has a DTI, half that, of 30%.

Essentially, the lender looks at your DTI as a key indicator of risk in doing business with you. Home buyers with higher debt-to-income ratios are more likely to default on their mortgages and other debt in general.

This is why calculating your DTI will be part of the mortgage underwriting process. In general, 43% is the highest DTI you can have and still get what lenders call a qualified mortgage. A qualified mortgage is preferred because it comes with better rates and terms as well as limits on the fees the bank can charge you.

What’s a Good Debt-to-Income Ratio?

While 43% is the maximum DTI you can have to qualify for a qualified mortgage, 36% is the DTI that is considered to be the most you should seek to have.

In general, the 36% Rule states that your DTI should never pass 36%. A DTI of 36% gives you more wiggle room than a DTI of 43%, putting you in the position to handle, more effectively, any changes in your income and expenses. Naturally, the lower your DTI, the more attractive you are as a risk for lenders, but 36% is really the ceiling you should shoot for.

Your DTI in short

A good DTI means you are more financially secure. The lower it is, the more affordable your debts are. With a low DTI, you can handle fluctuations in your income better and you’re a better risk for people who want to invest in you.

If you’d like someone to take a look at your DTI and let you know what kind of shape you’re in to get a great mortgage, click here. You’ll get access to a no-cost consultation with a credible financial expert who can give you the guidance you need to get your DTI where it needs to be to get some great deals on a mortgage.

Don’t leave your financial future to chance. Get your hands around your DTI and make it as strong as it can be.